Thailand currently ranks as the second-biggest food exporter in Asia, trailing only China, according to the Food Processing Industry Club under the Federation of Thai Industries. The country is the world’s No. 1 producer and exporter of canned pineapple, pineapple juice, processed chicken, rice, canned and frozen seafood, and processed shrimp. Lush and tropical, Thailand is also a leader in sauces made from chilies, curry, soya, tomatoes, fish and oysters.

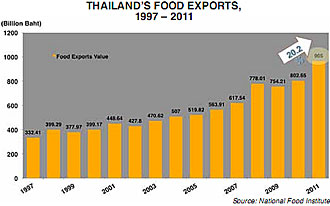

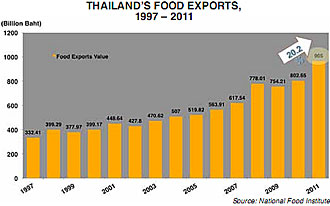

The National Food Institute projects that Thai food exports in 2012 will reach 1 trillion baht, up from 965 billion baht last year. The 10 member countries of the Association of Southeast Asian Nations (ASEAN) already represent Thailand’s largest food- exports destination in accounting for 20.6% of total shipments, followed by Japan at 14.6% and the United States at 12.8%. The launch of the ASEAN Economic Community (AEC) in 2015 will lift Thai food exports to even greater heights through the country’s closer economic cooperation with its fellow bloc members Singapore, Malaysia, Indonesia, Vietnam, Cambodia, Laos, Myanmar, Brunei and the Philippines. With the AEC’s elimination of trade tariffs, ASEAN countries are expected to absorb a hefty 30% of Thailand’s food exports after single market integration.

A seamless AEC market means that Thai companies can sell products to the ASEAN countries much easier. This will fatten up companies’ revenue, and the additional funds would enable them to invest in R&D and upgrading to elevate competitiveness.

In line with this, new programs are cropping up as Thailand’s food industry anticipates the free flow of goods and services under the AEC. For example, the Ministry of Industry in April 2012 announced a “food valley” project that will boost the country’s productivity. Over coming years, Chiang Mai and Nakhon Ratchasima in the north will be developed as pilot provinces with food companies and research institutes locating there in clusters for highly efficient production, R&D and logistics. A budget of more than 30 million baht has been set aside for the project this year. After a trial run, provinces in central and southern regions will be considered for project expansion.

Under another initiative, the Thai government is encouraging small and medium-sized (SME) food enterprises to engage with companies across the AEC so they can acquire new technologies and ideas to push up their capability.

Even though formation of the AEC gives Thai food companies a chance for business expansion, it also presents challenges. This is especially the case for SMEs in the upstream sector of the industry.

“Overall we see a positive impact from the AEC. But it can depend on whether you are downstream or upstream,” said Wimonkan Kosumas, deputy director general of the Office of Small and Medium Enterprises Promotion.

“Thai SMEs in processed and ready-to-eat food will have a lot of opportunities in trade and outward investment. This is because Thai cuisine has a very high brand image for quality and safety and the popularity of Thai food is growing in Asia. On the other hand, Thai upstream companies providing materials might not be able to compete with countries such as Myanmar and Vietnam after the AEC because raw materials are cheaper there,” she added.

Although the nascent AEC economic bloc is getting a lot of attention right now, Thailand also has free trade agreements with India, China, Japan and Australia that extend opportunities for food industry investors.

Food processing is the core strength of the Thai industry. The country’s food processing sector is comprised of more than 10,000 companies. Major Thai and multinational players include Nestle, Saha Pathana Inter Holding, Patum Rice Mill & Granary, Royal Friesland Foods NV, Unilever, Thai Union, Dole, Charoen Pokphand Group, Betagro, Saha Farms, Thai Beverage, Kellogg’s, Kraft, PepsiCo, Del Monte, Procter & Gamble, Ajinomoto and Effem. |

Thailand’s annual production of processed food reaches more than 28 million tons. Government and industry initiatives have helped the processed-food sector upgrade procedures and technologies to international quality standards, bolstering the country’s global competitiveness. GMP, GHP, HACCP and ISO are among the certifications and practices followed.

To support the sector, the Thailand Board of Investment offers a range of fiscal and non-tax incentives to investors. Tax-based incentives include exemption of import duties on machinery and raw materials, and corporate income tax exemptions in all zones. Among the non-tax incentives are permission to bring in foreign workers, own land, and take or remit foreign currency abroad.

Despite advancement by the local industry, Thailand continues to import a substantial portion of the machinery used in the preparation of food and beverages. Such imports totaled US$166 million in 2011. The majority of equipment is sourced from Japan (26%), the Netherlands (11%), Germany (11%) and China (10%). Food industry machinery is therefore considered an area ripe with investment opportunity.

Industry Generating Specialty Sectors

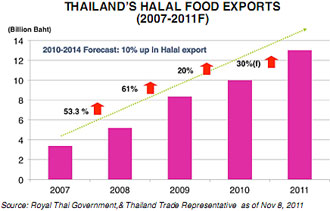

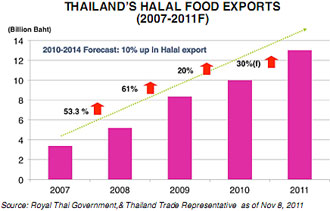

Reflecting the vibrancy of the Thai food industry, new specialty sectors are developing rapidly. One of these is halal food, an area deemed to have high investment potential. The sector is expanding on the strength of Thailand’s sufficiency of raw materials for halal food production. So far this has supported the establishment of more than 2,000 processing facilities.

The reliable control standards in the country are also a growth factor. Halal food products must adhere to strict Islamic dietary rules. In particular, Muslims cannot consume pork, other animals not slaughtered properly, birds of prey and blood products. As such, Thai halal products are processed in accordance with the Central Islamic Committee of Thailand’s scientific regulations on manufacture facilities, raw materials, storage, employees and transport.

Offering over 35,000 halal-certified products, Thailand is the world’s fifth-biggest maker in the line. It ranks No. 1 for halal exports among ASEAN countries. Investors in Thailand enjoy market proximity to neighboring countries with large Muslim populations. Singapore, Malaysia, Indonesia, Brunei, the UAE, Saudi Arabia and Egypt are currently the main markets for Thai- made halal food products. With 30 million Muslims, China is seen as a potentially lucrative halal market to be cultivated. Thai halal entrepreneurs are also well located to develop business opportunities in Mongolia, Russia, Kazakhstan, Kyrgyzstan and Pakistan.

To ensure steady progress in the sector, the Thai government has forged a range of strategies that will increase exports of halal food, including vegetables, fruit, and fishery and livestock products. The emphasis is on enriching R&D and building the five southernmost provinces of Pattani, Yala, Narathiwat, Satun and Songkhla and the sea resort of Phuket into major production bases for halal products in Asia.

Medical food is another emerging sector, adding to the abundance of Thailand’s food industry. As generally defined, medical food consists of products specially formulated for the dietary management of diseases with distinctive nutritional needs that cannot be met by a normal diet. Medical food is used as new treatments for disorders and diseases ranging from asthma to diabetes to Alzheimer’s. Formulas might contain ingredients such as gamma-linolenic acid from the seeds of the borage plant or eicosapentaenoic acid sourced from fish.

More major producers of medical food are establishing facilities in Thailand, attracted by the country’s cost-effective manufacturing and strategic location in the Asia-Pacific market. Mead Johnson, Abbott, Novartis and Thai Otsuka Pharmaceutical are among the leading makers of medical food in Thailand. Businesses in this sector also benefit from the world-class reputation of Thailand’s medical services industry, which attracts 2 million foreign patients annually.

Strong fundamentals all the way around will sustain the growth and prosperity of Thailand’s ample food industry, preserving its status in coming years as a major global production base and attractive location for international investors. |