Module 13: Small and Medium Enterprises in ASEAN

Table of Contents

Reading Text & Presentation

13.3 Methods of payment

It is important for all companies engaging in international trade to fully understand the standard methods of collecting money from foreign importers and distributors. Each payment method carries certain risks and costs, which often are the responsibility of the exporter. Initially, cash in advance or letters of credit are used and then moved to more flexible forms of payment, for example the use of an open account.

The standard methods of payment used in international trade are:

- 13.3.1 Cash in advance

- 13.3.2 Open account

- 13.3.3 Draft (Documentary collections)

- 13.3.4 Commercial letters of credit

Payment Risk

(Source: http://trade.gov/media/publications/pdf/trade_finance_guide2007ch1.pdf retrieved 10/5/2014)

13.3.1 Cash in advanceCash in advance is used on low-value shipments, usually when the buyer has significant interest in obtaining products from the seller, access to the preferred method of currency, and is quite fiscally sound. Nevertheless, it is the least preferred method of payment for the buyer.

|

||||

13.3.2 Open accountIn this method, the buyer receives delivery of the goods and services before making payment. It involves delivery of your goods or services to the buyer with an invoice requesting payment at a certain time after delivery. The time given to the buyer to pay is called a ‘credit term’.

|

||||

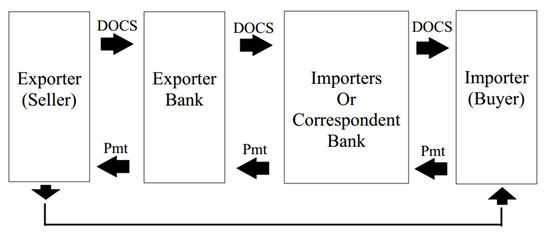

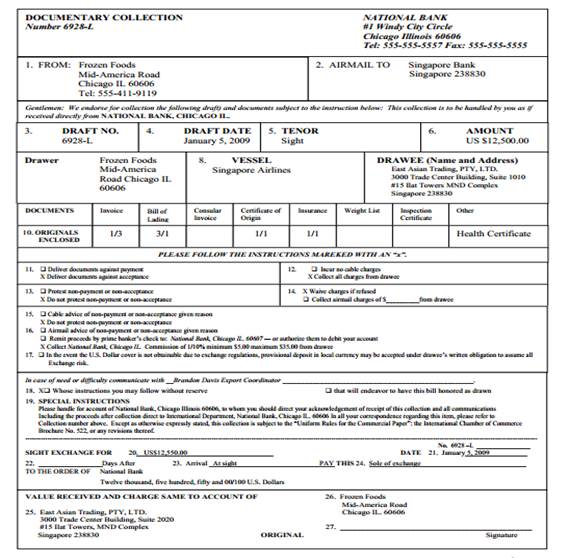

13.3.3 Draft (Documentary collections)This payment method is often used in the exchange of merchandise for money. The goods are shipped to the foreign country, but the documents are sent to the buyer’s bank. Then, the buyer’s bank will release possession of the documents when the buyer makes payment arrangements or signs a promise to pay at a later date. Under this method, an exporter can be paid on a sight draft/time draft or be paid on a sight/time letter of credit to indicate what type of draft is to be shown together with the L/C and documents for payment.

(Source: http://fea.files.cms-plus.com/ExportEssentials/9collectionflow.pdf retrieved 17/2/2014) |

||||

13.3.4 Commercial letter of creditA letter of credit (L/C) is commonly used because of high risk of non-payment. It is an electronically generated contract between the buyer’s bank and the exporter. The buyer’s bank substitutes the credit of the buyer with their own, at a fee and with a set of instructions to secure payment. Under this term, the buyer’s bank enters into a letter of credit contract with the seller, stipulating them as the beneficiary. The buyer’s bank then (usually) contacts a bank and asks them to either advise the letter of credit to the seller or to add their confirmation. By adding their confirmation, the bank agrees to pay the beneficiary even if they are unable to collect from the issuing (buyers) bank. The most important aspect of a letter of credit is that the banks involved have no obligation to pay in the event of serious discrepancies on the documents supplied by the beneficiary (seller).

(Source: http://fea.files.cms-plus.com/ExportEssentials/9draft%20Dennis.pdf retrieved 12/4/2014)

Procedure of the Letter of Credit

(Source: Adapted from https://www.foodexport.org/GettingStarted/content.cfm?ItemNumber=1294 retrieved 13/6/14) |

Differences between drafts and letters of credit

| Draft | Letter of Credit |

1. Obligation to pay |

|

The obligation to pay is with the buyer. |

The obligation is with the issuing/confirming bank. |

2. Risk to seller |

|

The seller has higher risk with payment by collection. |

The seller has lower risk with payment by collection. |

3. Documentation |

|

Documentation is not checked for accuracy on collection. |

Documentation is checked for accuracy on collection. |

4. Role of the bank |

|

The bank’s role is passive on collection. |

Letter of credit is very active because the issuing or confirming bank has substituted its credit for the buyer. |

Summary of payment methods

| Method | Usual time of payment |

Goods available to buyer |

Risk to seller |

Risk to buyer |

Cash in advance |

Before shipment |

After payment |

None |

Complete. Relies on seller to ship exactly the goods expected, as quoted and ordered |

Open account |

As agreed, usually by invoice |

Before payment |

Relies completely on buyer to pay account as agreed |

None |

Draft |

Remittance time from buyer's bank to seller's bank may still take one week to one month |

|

Drafts, by design, should contain terms and conditions mutually agreed upon |

|

Letter of Credit (L/C) |

|

|

Commercial invoice must match the L/C exactly. Dates must be carefully headed. "Stale" documents are unacceptable for collection |

|