Module 6: ASEAN Legal Aspects

Table of Contents

Activities

Activity 8

Log on to the following website and answer the questions.

(Source: http://www.dejudomlaw.com/guide/december-2013/ retrieved 11/2/2014)

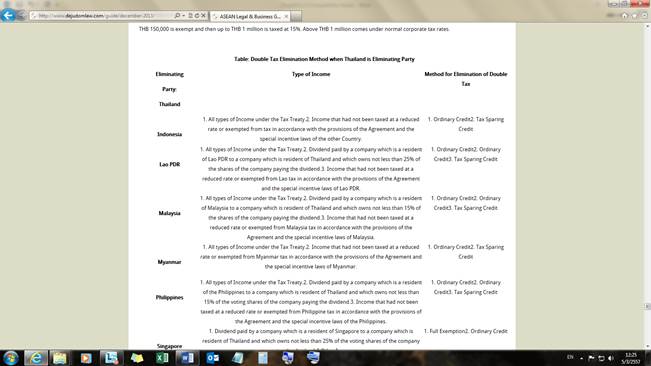

Table: Double Tax Elimination Method when Thailand is Eliminating Party

Eliminating Thailand |

Type of Income |

Method for Elimination of Double Tax |

Indonesia |

1. All types of Income under the Tax Treaty. 2. Income that had not been taxed at a reduced rate or exempted from tax in accordance with the provisions of the Agreement and the special incentive laws of the other Country. |

1. Ordinary Credit |

Lao PDR |

1. All types of Income under the Tax Treaty. 2. Dividend paid by a company which is a resident of Lao PDR to a company which is resident of Thailand and which owns not less than 25% of the shares of the company paying the dividend. 3. Income that had not been taxed at a reduced rate or exempted from Lao tax in accordance with the provisions of the Agreement and the special incentive laws of Lao PDR. |

1. Ordinary Credit |

Malaysia |

1. All types of Income under the Tax Treaty. 2. Dividend paid by a company which is a resident of Malaysia to a company which is resident of Thailand and which owns not less than 15% of the shares of the company paying the dividend. 3. Income that had not been taxed at a reduced rate or exempted from Malaysia tax in accordance with the provisions of the Agreement and the special incentive laws of Malaysia. |

1. Ordinary Credit |

Myanmar |

1. All types of Income under the Tax Treaty. 2. Income that had not been taxed at a reduced rate or exempted from Myanmar tax in accordance with the provisions of the Agreement and the special incentive laws of Myanmar. |

1. Ordinary Credit |

Philippines |

1. All types of Income under the Tax Treaty. 2. Dividend paid by a company which is a resident of the Philippines to a company which is resident of Thailand and which owns not less than 15% of the voting shares of the company paying the dividend. 3. Income that had not been taxed at a reduced rate or exempted from Philippine tax in accordance with the provisions of the Agreement and the special incentive laws of the Philippines. |

1. Ordinary Credit |

Singapore |

1. Dividend paid by a company which is a resident of Singapore to a company which is resident of Thailand and which owns not less than 25% of the voting shares of the company paying the dividend. 2.Other Income |

1. Full Exemption |

Vietnam |

1. All types of Income under the Tax Treaty. 2. Income that had not been taxed at a reduced rate or exempted from Vietnamese tax in accordance with the provisions of the Agreement and the special incentive laws of Vietnam. |

1. Ordinary Credit |

|

|

How is Singapore different from other countries in types of income? |

|

What does ‘ordinary credit’ mean? |

|

What does ‘tax sparing credit’ mean? |

|

What does ‘eliminating party’ mean? |

|

- It does not have “1. All types of Income under the Tax Treaty”

- All types of Income under the Tax Treaty.

- Income that had not been taxed at a reduced rate or exempted from tax in accordance with the provisions of the Agreement and the special incentive laws of the other Country.

- The party that is involved with stating the restrictions or exemptions in an agreement.