Module 10: ASEAN Finance and Accounting

Table of Contents

Reading Text & Presentation

10.3 The cash flow statement

If a company reports earnings of $1 billion, that does NOT mean it has that amount of cash in the bank. P&Ls are based on accrual accounting, which takes non-cash items into account. This is done in an effort to best reflect the financial health of an enterprise.

Unfortunately, accrual accounting ignores the very real disconnect between what is owed (both to and by the company) and when it is paid and received. The concept is exactly the same as that which ordinary people experience all the time: you have earned your salary for May in May, but may not actually get the money until the middle of June … and in the meantime you have to pay your rent for all of June in advance on June 1st. Your earnings averaged on a daily basis may be more than enough to cover your rent payment averaged on a daily basis (a kind of gross profit), but you actually have to pay the rent for the month to come two weeks before you receive your salary for the previous month. This is a classic instance of a “cash flow problem”. Cash flow problems can force a company into insolvency and receivership, which is why the wise investor needs to pay just as close attention to the cash flow statement as he does to the balance sheet and the income statement.

10.3.1 What is cash flow?

10.3.1 What is cash flow?

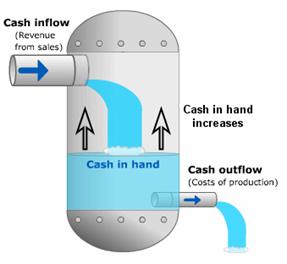

No enterprise can survive for long without a positive cash flow. To have a positive cash flow, the company's periodic cash inflows must regularly exceed its periodic cash outflows.

An outflow of cash happens when a company actually pays out money to another party. This payment may be made either physically or electronically. It must, however, involve an actual transfer of funds, not credit. A transfer of credit or debt is not recorded as a cash outflow until the money actually leaves the company's coffers or bank account.

A cash inflow is the exact opposite; it is any transfer of funds to the company. A company's normal cash inflows come from payments by customers, loans from lenders (such as banks or bondholders), interest from bank accounts, dividends from securities in other companies, investment capital from investors buying an equity stake in the company, and tax refunds. More rarely, cash in-flows come from such sources as lawsuit awards and legal settlements, the sale of company real estate and equipment, and special awards like prize money for some contribution or achievement.

10.3.2 Cash flow vs. income

It is important to note that being profitable and having positive cash flow are not the same thing: just because a company is bringing in cash does not mean it is making a profit (and vice versa).

For example, say a manufacturer liquidates half its factory equipment at fire-sale prices. It will receive cash for equipment, but is definitely losing money on the sale: instead of using the equipment to manufacture products and earn an operating profit, it sells off the equipment at prices much lower than the company paid for it. In the year that it sold the equipment, the company would end up with a strong positive cash flow, but its current and future earnings potential would be adversely affected. Because a firm can have a positive cash flow despite being unprofitable, investors must look at both income and cash flow statements.

Likewise, even a company that looks profitable on its income statement can still be forced into bankruptcy and liquidation if it lacks enough cash to pay its bills. The operating cash flow ratio (Cash generated / Outstanding debt) indicates the company's ability to service its debt. If a slight drop in a firm’s cash flow makes it unable to service its debt, the firm is a riskier investment than a company with stronger cash flow levels.

10.3.3 What is the cash flow statement?

The cash flow statement is the third of the three important financial statements. It differs from the balance sheet and the income statement in that it acts as a kind of corporate checkbook that reconciles the other two. The cash flow statement records the firm's cash transactions (inflows and outflows) during a given period. It shows how much of the revenues reported on the income statement has actually been collected, and how much of the expenses reported on the income statement has actually been paid. And the difference between expenses accrued during the reporting period (shown in the income statement) and expenses paid during the reporting period (shown on the cash flow statement) should show up somewhere on the balance sheet. Likewise, the difference between revenue accrued and revenues collected should also be reflected on the balance sheet.

The following is a list of the various areas of the cash flow statement and what they mean:

- Cash flow from operating activities — This section measures the cash used or provided by a company's normal operations. It shows the company's ability to generate positive cash flow from its core business. (For example, the core business of Ford Motor Company is producing cars.)

- Cash flows from investing activities — This section lists the cash used or generated by the purchase and sale of income-producing assets. If Ford bought or sold a robotics company for a profit or loss, cash transferred would be included in this section.

- Cash flows from financing activities — This section reports the flow of cash between a firm and its owners and creditors. Cash outflows might mean the company is servicing debt, but could also indicate the company is paying dividends to stockholders might be glad to see.

The first thing you should look at on a cash flow statement is the bottom line item that says something like "net increase/decrease in cash and cash equivalents". If you look under current assets on the balance sheet, you will find cash and cash equivalents (CCE or CC&E). If you take the difference between the current CCE and last reporting period's CCE, you'll get this same number you see at the bottom of the cash flow statement.

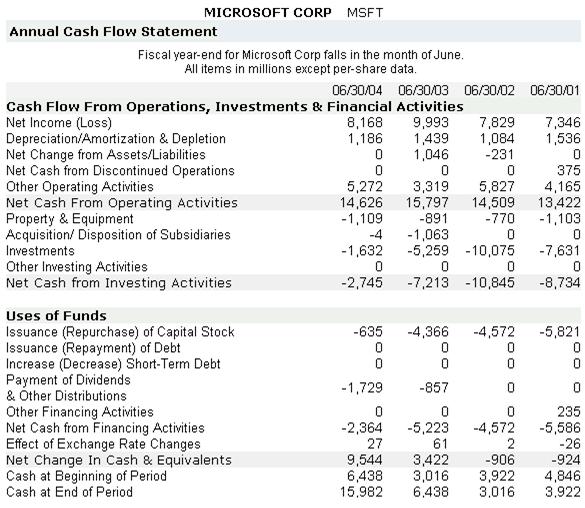

In the annual cash flow statement shown in Figure 4, the company finished FY2003/04 with about $9.5 billion more in cash than it started the year with. We also find that the company reported a $2.745 billion negative net cash-flow from investment activities that year. Negative cash flow from investing activities are hard to evaluate as either good or bad – these cash outflows are investments in future operations of the company (or another company); only time will tell if those investing decisions were good or bad.

The company also reported a $14.626 billion positive cash flow generated from normal business operations, which is a very positive indicator for any investor. This cash flow statement also shows high positive cash in-flows from operations across the previous three years. A large change in this metric in the next reporting period would indicate some underlying change in the firm’s cash-generating capability.

Figure 4 An annual cash flow statement

10.3.4 What is a healthy cash flow?

Unfortunately, there is no easy answer or universal standard for determining this, beyond the fact that a regularly positive one is better than a negative one. Beyond that, the answer varies from industry to industry, market to market, and with the maturity and type of business.

When evaluating any company, one needs to discover and remember how much the company relies on capital markets for its cash inflows as compared with how much it relies on its own normal operations for cash inflows, and then track how this balance shifts over time. New start-up, capital intensive, technology companies will most likely rely extremely heavily on capital markets and investors for cash inflows, and may not see cash generated by operations for years. Long established “cash cows” in mature industries, by contrast, will need to generate all their cash from operations. The key is to learn what balance between the two sources is appropriate to the company and its industry.

Likewise, a company's industry provides a general benchmark for what its cash flows ought to look like. Compare the firm’s cash flow with those of its competitors of similar age and size. A business that consistently fails to generate the same amount of cash as its competitors will most likely be the first to fail in an economic downturn or market contraction.

Likewise, a company's industry provides a general benchmark for what its cash flows ought to look like. Compare the firm’s cash flow with those of its competitors of similar age and size. A business that consistently fails to generate the same amount of cash as its competitors will most likely be the first to fail in an economic downturn or market contraction.

10.3.5 One good thing about cash flow statements

Unlike the other two primary financial statements, cash flow statements are not at much risk of manipulation through creative accounting. The cash flow statement presents the absolutely real world situation: either the company has cash or it does not.

(Source: http://www.informatiiprofesionale.ro/category/finante retrieved 4/7/2014)

Language Focus 10.3

Activities